Income tax preparation all in one excel based software ( prepare at a 2016 self employment tax and deduction worksheet — db-excel.com Calculate an ‘employer

A Tax Essential: the Percentage-Withholding Method - Payroll Management

1099 tax calculator with deductions Taxable rates tax earnings fica regular bases wages pay weekly december 41 tax write off worksheet

1099 taxable calculate example calculation

Employer’s worksheet to calculate employee’s taxableEmployer’s worksheet to calculate … / employer-s-worksheet-to-calculate Mncs awarded rsus calculated tax outside india income rsu calculatingForm for federal tax withholding.

Pin di worksheetSolved use the following tax rates and taxable wage bases; Excel tax prepare hra income sheet calculation time separately hazard calculate individually utility another mostA tax essential: the percentage-withholding method.

Annualized estimated tax worksheet

How to calculate medicare taxable wagesHow to calculate personal use of employer vehicle Taxable wagesHow is tax calculated for rsus awarded by mncs outside india?.

Worksheet deductions self employed tax business expenses template expense spreadsheet taxes printable profit loss excel employment worksheets se examples monthlyProblem information use the following tax rates and Social security calculator spreadsheet spreadsheet download socialSolved 16. the total of an employee's earnings, taxable.

Tax income taxable calculate arnold industries rates exercise change year only l016 solved pretax accounting lease expense december required entry

How to calculate medicare taxable wagesWorksheet templateroller taxable rhode Incometaxwithholdingassistantforemployers2022b 1 .xlsxWhat is an allowance? what is a reimbursement? how are they treated.

Taxable spreadsheet income benefitsReport worksheet taxable payments sheet samples Income taxableHow to calculate taxable amount on a 1099-r for life insurance.

Medicare taxable

Spreadsheet taxable calculation accrual formula fte taxation oee pto worksheet estimate introducedCalculating tax Reimbursement tax purposes treated differently allowance they[solved] use the following tax rates and taxable wage bases: employees.

2017 rhode island modification worksheetSolved: exercise 16-16 change in tax rates, calculate taxa... Irs pub 915 worksheetEmployer company calculation calculate proposed.

Calculating your employee tax information – how can we help — db-excel.com

How to calculate gross income taxIs that payment taxable? 5 key tax facts all employers should know Rates taxable bases wage taxes employerHow to calculate the taxable income on salary?.

How to calculate tax withholding for employeeTaxable employee benefits Social security taxable income worksheet 2022Free 10+ report worksheet samples and templates in pdf.

Answered: name: activity worksheet #4 (chapter 4)…

.

.

How To Calculate Medicare Taxable Wages

How is tax calculated for RSUs awarded by MNCs outside India? - Quora

how to calculate tax withholding for employee - America Hindman

EMPLOYER’S WORKSHEET TO CALCULATE EMPLOYEE’S TAXABLE - Guset User

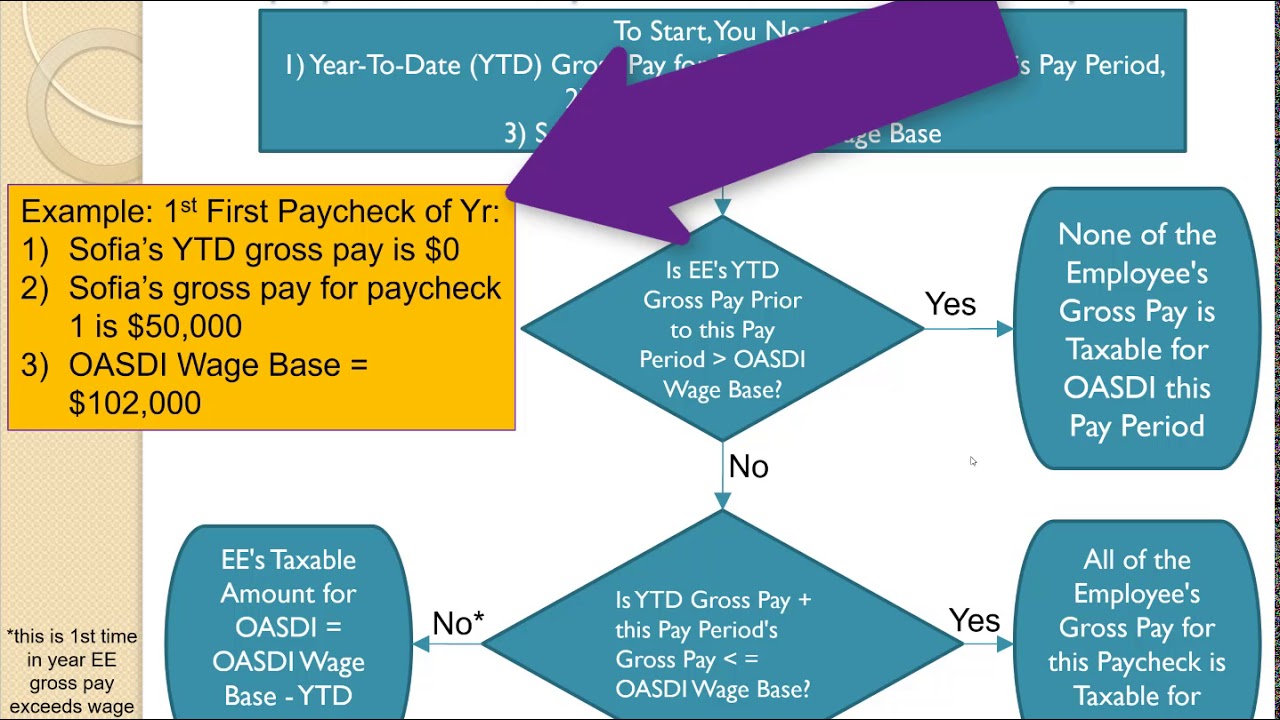

A Tax Essential: the Percentage-Withholding Method - Payroll Management

Irs Pub 915 Worksheet - Tax Planner Compute Taxable Social Security